Zerodha IPO Review (Apply Steps, UPI and Allotment Status)

Zerodha offers online IPO applications to its customers. Zerodha customers can apply for IPO using UPI (Unified Payment Interface) through the Zerodha Console website. While the process is not as easy as the ASBA IPO application through the 3-in-1 account, the Zerodha UPI IPO application offers an option to Zerodha customers to apply in IPO online.

Zerodha launched Online IPO application services on Aug 6, 2019. Since then it becomes the largest broker by the number of IPO applications being applied.

Zerodha IPO Apply

Applying in IPO through Zerodha is simple and convenient. It's a 3-step process:

- Create UPI ID on BHIM UPI app (One Time)

- Apply on Zerodha Console using your UPI ID

- Check mandate notification on the BHIM UPI app or net-banking app and approve with UPI PIN

Zerodha IPO Steps

Zerodha IPO application process (step-by-step guide) is described as below:

1. UPI ID Creation (One Time)

Zerodha offers IPO applications through UPI as a payment gateway. Read UPI for IPO Application (Unified Payments Interface for IPO) for more detail.

Zerodha customer first has to create a UPI ID, if they don't have one. UPI ID can be created using BHIM UPI App or using the online mobile banking app of any bank including ICICI, and HDFC where you hold your account.

2. Apply in IPO using Zerodha Console

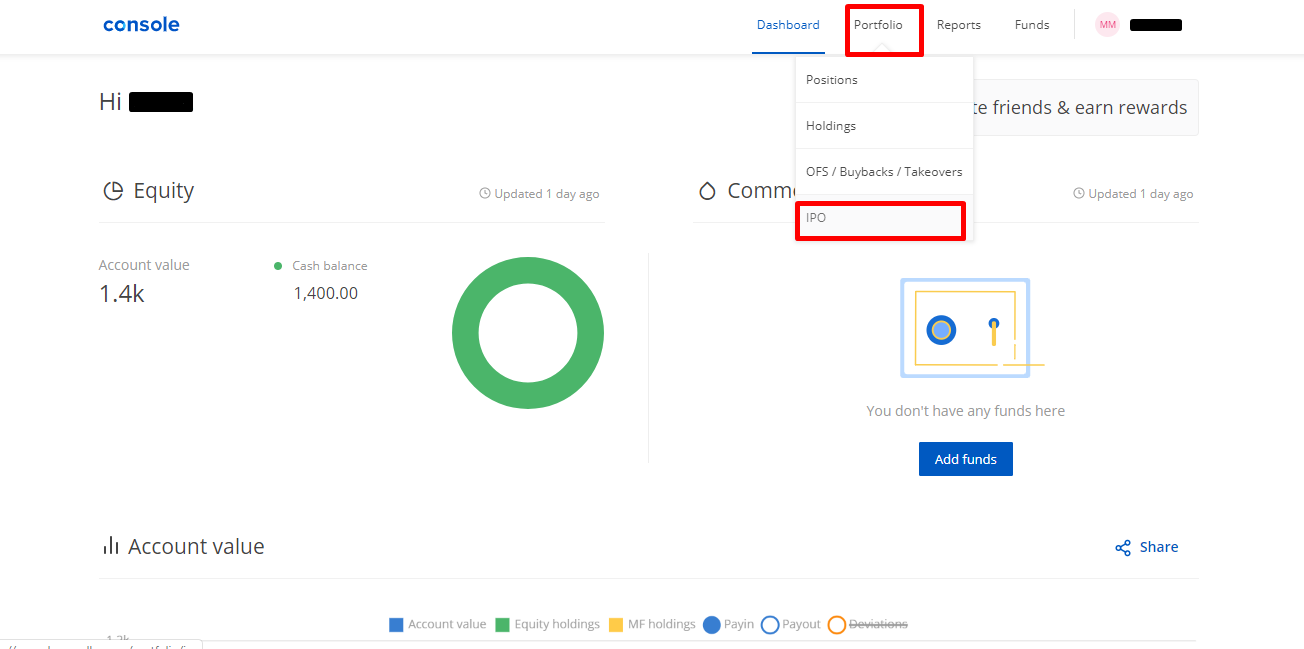

- Login to Zerodha Kite Website and go to Console (Zerodha Back-office)

- Go to Portfolio > IPOs

- Select the IPO from the list and click Apply

- Enter your UPI ID, quantity, and price

- Submit the application

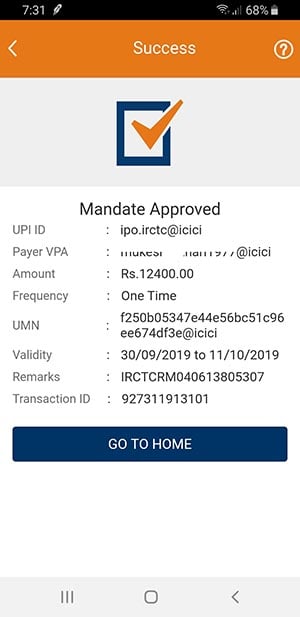

3. Accept the UPI Mandate

- After a few hours (usually the end of the day), you will receive a mandate request on your UPI app (either BHIM or your net banking App)

- Approve the standing instruction (mandate).

Zerodha IPO without UPI

You can apply for an IPO without UPI. You can apply using the ASBA net-banking services provided by the company and give your Zerodha demat account number so that the allotted IPO shares are credited to your account. We have detailed IPO application process for some major banks here-

- ICICI Bank IPO Application Guide

- SBI IPO Application Guide

- HDFC IPO Application Guide

- Kotak IPO Application Guide

- Axis Bank IPO Application Guide

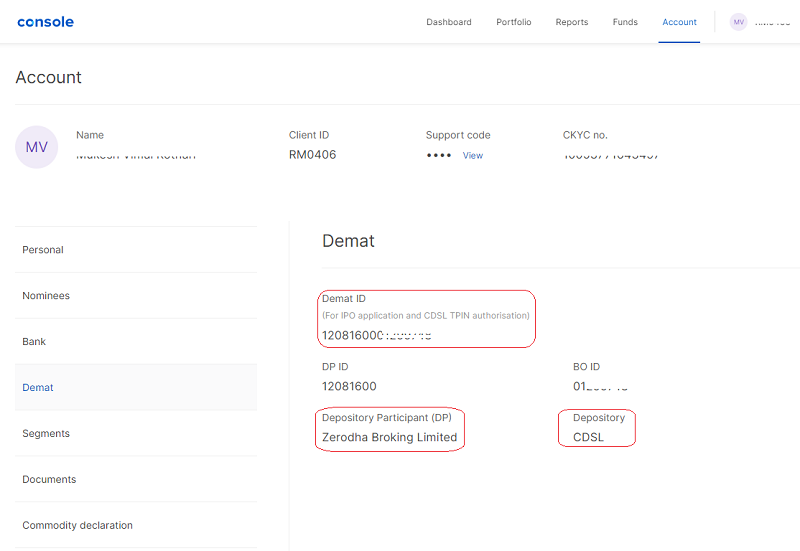

Zerodha DP name for IPO

Zerodha DP name for IPO is Zerodha Broking Limited.

An IPO application requires the depository (DP or demat account) details to get the credit of stocks. The depository details include the DP ID, DP Name, and Client ID. These details get auto-picked from your profile when applying for an IPO using the UPI route. However, when you apply using any other mode (offline or ASBA Net banking), you need to provide the Zerodha DP details to get the credit of shares in the Zerodha Demat account.

You can find your Zerodha DP details under your Profile >> Demat in Console.

DP details of Zerodha for IPO application:

- Depository : CDSL

- DP Name : Zerodha Broking Limited

- DP ID : 12081600

- Client ID/BO ID : 99999999 (8-digit unique ID assigned to each customer)

- Demat ID : 1208160099999999 (Combination of DP ID and Client ID)

Zerodha IPO Timing

The IPO window in Zerodha is open from 10 AM to 4.30 PM. You can apply or modify an IPO application anytime during this window through Zerodha Console while the IPO is open. If you want to delete the application, you can cancel your IPO application between 12 PM to 4:30 PM.

Zerodha IPO Charges

Zerodha IPO application service is free. Zerodha doesn't charge any fees from its customers for applying in an IPO.

Zerodha IPO Allotment Status

Zerodha IPO status check can be done from the IPO registrar's website. Registrar of the IPO (i.e. Karvy, Link Intime) is responsible for IPO share allotment. They publish the allotment status on their website once the share allotment process is complete.

You can also check the Zerodha IPO Allotment Status here on our website at IPO Allotment Status Page.

While IPO allotment status is not available on the Zerodha website, you get an alert from CDSL when IPO allocated shares are credited in your demat account.

Conclusion

Zerodha offers easy and convenient online IPO application services through their website and mobile app using UPI as a payment gateway. You can also apply using the ASBA facility if you do not have the UPI ID or are facing issues using UPI.

Zerodha Special Offer

Free stock trading and mutual funds

- Brokerage-free share delivery trades and flat Rs 20 per trade for Intraday & F&O +

- Brokerage-free Direct Mutual Fund investment + +

- Trade with the best trading platform in India.

This is a limited time offer. Open an instant Zerodha account online and start trading today.

Frequently Asked Questions

1. Does Zerodha offer IPOs?

Yes, Zerodha provides an online IPO application service using UPI as a payment gateway. Zerodha customers can apply for an IPO online from within Console and pay using any UPI 2.0 enabled app. You need to take the following steps to apply for IPOs online with Zerodha:

- Login to Zerodha Console

- click on the 'Portfolio' menu and select 'IPO'

- Choose the IPO you want to apply for from the list

- Enter your UPI ID

- Enter bid details like price, quantity, etc. and Click Submit

- You will receive a 'Mandate' request on your UPI app, click 'Proceed' and you're done.

2. Does Zerodha have IPO?

Yes, Zerodha offers IPO since Aug 2019 through UPI as a payment method. Once you setup your UPI ID, it's convenient to apply in IPO through Zerodha Console.

Visit Zerodha IPO Review page for more detail.

3. Does Zerodha allow IPO?

Yes, Zerodha allows its customers to apply for IPO online from Zerodha Console website. The investment amount needs to be paid using a UPI 2.0 enabled app. Here are the steps to apply in an IPO:

- Login to the Zerodha Kite website.

- Go to Console >> Portfolio >> IPO.

- Choose the IPO you want to apply for from the list

- Enter your UPI ID and enter bid details like price, quantity, etc.

- Check the details and Click Submit

- You will receive a 'Mandate' request on your UPI app by the end of the day, click 'Proceed' and you're done.

4. How to apply for IPO in Zerodha?

Zerodha customers can apply in IPO in 4 easy steps. Before applying in IPO, please make sure that you have a UPI id.

- Login to Kite and go to Console

- In Console, go to Portfolio > IPOs

- Select IPO and fill the application form

- Approve the mandate in the UPI app, when it is received (usually by end of the day).

5. What are Zerodha IPO charges?

Zerodha doesn't charge any fee for applying in IPO. As Zerodha offers brokerage-free equity delivery trades, they don't charge any commission when you sell allocated IPO shares through Zerodha.

Note: When selling IPO shares through Zerodha, you still have to pay government taxes and demat debit transaction changes.

6. How to check the status of IPO through Zerodha?

Zerodha doesn't provide IPO application status on its website. Visit the website of the registrar of the IPO (i.e. Karvy, Link Intime) to check the allotment status. You have to enter your PAN number to check the status.

7. How to apply for IPO in Zerodha without UPI?

Zerodha offers only UPI based IPO application. If you do not have UPI, you could create it for free from your banking mobile app (i.e. ICICI, HDFC) or BHIM UPI app. Creating UPI is a simple process.

Alternatively, you could apply in IPO's using the net banking of the bank where you have an account. Steps to apply in IPO using net banking are provided below:

8. What is Zerodha IPO Cutoff Price?

The IPO Cut-off Price is the price of a share decided by the issuer company based on the demand of its share during the IPOs where the range of price is given.

An option is given to retail investors to apply at a cut-off price in IPOs. This means the IPO applicant doesn't have to choose a price. They can simply choose the 'cut-off' option and the shares are allocated at the cut-off price.

For example; a company came up with an IPO with a price range of Rs 80 to Rs 90. Instead of choosing a number between 80 and 90, a retail investor can choose Cut-off. In this case, the investor will get the shares based on the price at which shares are allocated in other categories i.e. Institutional investors.

9. What if the Zerodha IPO Mandate is not working?

Once you submit the IPO application in Zerodha Console, you should get a mandate in the UPI app to approve. It takes up to 24 hours to get the mandate. The process of getting the mandate to approve payment is not instant. The IPO application completes only when you approve the UPI transaction (mandate).

10. How to buy an IPO via Zerodha?

To buy IPO via Zerodha follow 3 steps:

- Get a UPI ID

- Visit Zerodha Console > Portfolio > IPO to apply

- Approve the UPI mandate in the mobile App.

11. Is IPO Investment can be possible with Zerodha?

Yes. Zerodha offers online IPO investment using UPI as a payment gateway. You could also apply in an IPO using your Zerodha demat account and ASBA facility offered by any bank like ICICI, HDFC or Axis where you have an account.

Visit Zerodha IPO Review page for more detail.

12. Can I bid for IPO from funds available on Zerodha Kite?

No, you cannot use the funds in Zerodha Trading Account to apply in an IPO. Zerodha uses UPI as a payment option for online IPO applications. The UPI is a unique ID for your bank account. When applying in an IPO with UPI ID, the funds are locked in your bank account.

13. How to apply in an IPO in the HNI category with Zerodha?

Zerodha offers UPI based IPO application that has a limit of a maximum of Rs 2 lakh per transaction. It means you cannot apply in the HNI category using the Zerodha IPO application. You have to use ASBA offered by the banks to apply in the HNI category.

14. How to check IPO allotment in Zerodha?

Zerodha does not maintain the IPO allotment status check on their website.

You can check for the Zerodha IPO allotment status from the IPO registrar's website or visit our website page - IPO Allotment Status Page for the update.

15. How to invest in IPO through Zerodha?

Zerodha offers its customers to invest online in IPO through Zerodha Console using UPI.

Steps to invest in IPO through Zerodha:

- Login to Zerodha Console using Kite credentials.

- Click on the Portfolio tab and select IPO from the dropdown.

- Select the desired IPO from the list of open IPOs.

- Click on 'Bid' to apply.

- Enter your UPI ID.

- Select the Investor type.

- Enter the Quantity and bid price/cut-off price.

- Tick on the box to accept the undertaking and submit the bid.

Accept the UPI mandate request once received to complete the IPO application process.

16. How to fill IPO in Zerodha?

You can fill IPO online in Zerodha through Zerodha Console using the UPI. Since Zerodha offers IPO through UPI, you cannot apply for an amount of more than Rs.2 lakhs.

Steps to fill IPO in Zerodha:

- Login to Zerodha Console.

- Go to the IPO section under Portfolio.

- Select the IPO for which you want to apply.

- Enter the UPI details.

- Enter the bid details viz. Quantity, Price, and Investor Type.

- Accept the undertaking and Submit.

- Accept the UPI mandate request once received to fill the IPO application successfully.

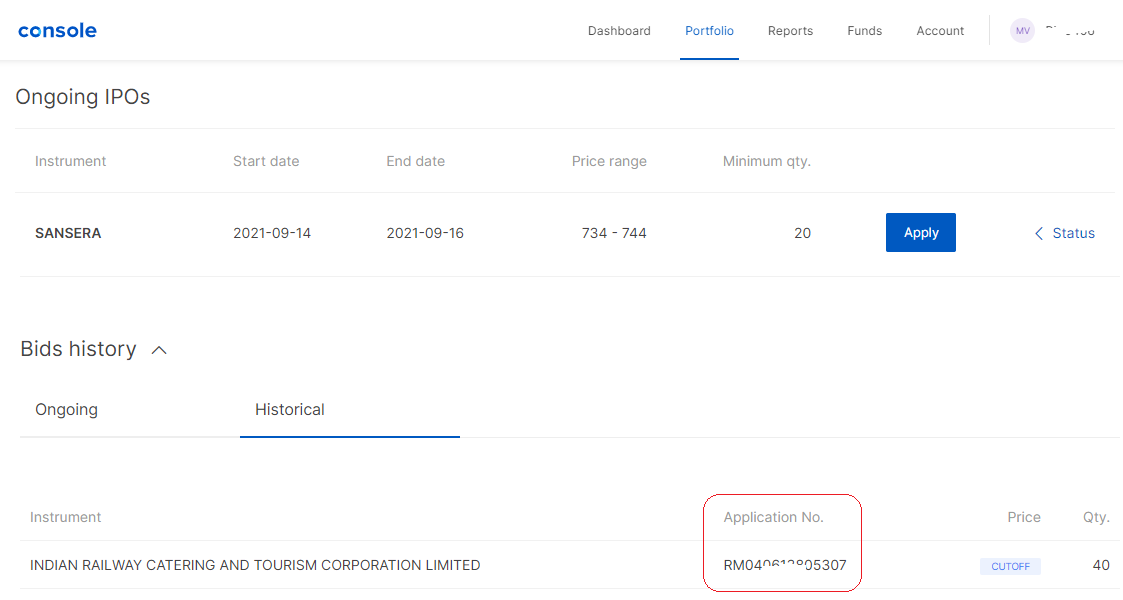

17. How to find the IPO application number in Zerodha?

You can find the IPO application number in Zerodha under the historical bids in the IPO section in Zerodha Console.

Steps to find the IPO application number in Zerodha:

- Log in to Zerodha Console.

- Go to the Portfolio tab.

- Click on IPO from the dropdown.

- Go to the Bids History section that will show the details of your ongoing and historical bids with the application number.

18. How to sell IPO shares in Zerodha?

The process to sell IPO shares in Zerodha is similar to the placement of any CNC sell order.

Steps to sell IPO shares in Zerodha:

- Log in to Zerodha Kite.

- Go to the holdings tab.

- Select the allotted IPO stock that you want to sell.

- Click on Exit.

- Enter/Modify the trade details as required viz. Quantity, Price, Order type.

- Click/Swipe to Submit.

You can sell the IPO shares on the listing day itself. However, the timings for IPO trading on the listing day are a bit different.

- You can place the sell order from 9.00 am to 9.45 am.

- There is a freeze period from 9.45 am to 9.59 am in which you cannot place, modify or cancel any order placed for the listed IPO.

- The Normal trading window for IPO starts at 10 am. You can place new orders, cancel or modify any unexecuted orders post 10 am.

19. How to subscribe for IPO in Zerodha?

You can subscribe for an IPO in Zerodha from 10 am to 4.30 pm during the IPO offer period using the UPI through Zerodha Console.

To subscribe for an IPO in Zerodha, you need to go to the IPO section under the Portfolio tab in Zerodha Console and select the IPO you wish to apply. Enter the IPO bid details and submit. You will receive a mandate request on the UPI app that needs to be accepted to complete the IPO subscription process.

20. How to modify IPO bid in Zerodha?

You can modify the IPO bid in Zerodha anytime between 10 am to 4.30 pm through Zerodha Console while the IPO window is open.

Steps to modify IPO bid in Zerodha:

- Login to Zerodha Console.

- Go to the IPO section under the Portfolio tab.

- Under the Ongoing IPOs, click on the Modify Bid button against the applied IPO.

- Modify the bid details as required.

- Click on Update.

21. How to cancel IPO application in Zerodha?

You can cancel the IPO application in Zerodha through Zerodha Console while the IPO window is open between 12 pm to 4.30 pm.

Steps to cancel IPO application in Zerodha:

- Login to Zerodha Console.

- Click on the Portfolio tab.

- Select IPO from the dropdown.

- Click on Modify Bid for the desired applied IPO under the Ongoing IPO section.

- You can either delete the entire order or the selected bid detail and click on update.

Zerodha Account Opening Enquiry

Invest without brokerage fees in Equity Delivery and Direct Mutual Funds. Pay a flat Rs 20 per trade for Intra-day and F&O. Open an instant account with Zerodha and start trading today.

Information on this page was last updated on Tuesday, April 11, 2023

Special Offer: Invest without brokerage fees in Equity Delivery and Direct Mutual Funds. Pay a flat Rs 20 per trade for Intra-day and F&O. Open an instant account with Zerodha and start trading today.

Information on this page was last updated on Tuesday, April 11, 2023

Follow DS Trading Tech for the Share Market Update, Stocks News, upcoming IPO news and their reviews, also keep following us on Twitter, Facebook, and Instagram. For our latest videos, subscribe to our YouTube channel.

By DS Trading Tech

👉Connect With us-

👉E-mail : rjdilipsuthar@gmail.com

👉FACEBOOK : https://www.facebook.com/profile.php?...

👉INSTAGRAM: https://www.instagram.com/Dilipsuthafintech

👉YouTube: ![]() / @dstradingtech

/ @dstradingtech

Click Here

EMS IPO Youtube Video Link - https://youtu.be/Ja-0oMsR_9I