Trade Setup for September 21: Nifty 50 to see more pain on weekly options expiry day?

By Dilip Suthar

Wednesday's drop in the markets left the investors poorer by Rs 2.9 lakh crore. Half of that drop came from HDFC Bank after the stock fell to a one-month low.

Geopolitical tensions, profit booking, higher crude prices and a resurgent US Dollar - a combination of all of these factors led to the Nifty 50 witnessing its worst single-day drop in two months. It closed below the 20,000 mark for the first time in five sessions.

Top GainersTop LosersMost ActivePrice ShockersVolume Shockers

| Company | Value | Change | %Change |

|---|---|---|---|

| Power Grid Corp | 204.65 | ₹4.55 | 2.27 |

| Coal India | 284.30 | ₹3.05 | 1.08 |

| ONGC | 188.20 | ₹1.45 | 0.78 |

| Sun Pharma | 1,153.15 | ₹5.50 | 0.48 |

| Eicher Motors | 3,441.20 | ₹9.45 | 0.28 |

Wednesday's drop left the investors poorer by Rs 2.9 lakh crore. Half of that drop came from HDFC Bank after the stock fell to a one-month low. We'll tell you more about that later in this piece. Reliance Industries was the other contributor to the downside.

Thursday's session will also be the weekly options expiry of the Nifty 50 contracts. Cues emerged from the US overnight where the US Federal Reserve kept interest rates unchanged for the second time in the past three meetings but Fed Chair Jerome Powell signalled one more hike this year before the cycle ends.

What Are The Experts Saying?

Mahesh Nandurkar of Jefferies after meeting with ministers, bureaucrats and experts in New Delhi believes that while political continuity is likely in 2024, fiscal pressures are building up with oil prices rising. "Potential re-allocation towards social spending might drive incremental pressure on PSU disinvestment," he wrote. Jefferies, therefore, has trimmed its weight on property, midcap industrials, staples and added Bharti Airtel and increased exposure to cash.

"Valuations are increasingly getting uncomfortable, especially within the small and mid-cap space. The frontline market still seems one where buy on dips can be the preferred strategy. Consumer space, metals and select large cap banks can be the drivers of keeping the Nifty 50 buoyant," Jaykrishna Gandhi of Emkay Global Financial Services said.

What Do The Nifty 50's Charts Indicate?

The Nifty 50 ended just above the 19,900 mark with its intraday low of 19,880 being the lowest since September 11.

"We are of the view that the intraday market texture is weak but due to temporary oversold conditions, we could see rangebound activity in the near future," said Shrikant Chouhan of Kotak Securities. For the bulls, 20,000 - 20,030 can be an immediate resistance while downside support could be seen between 19,825 - 19,775.

Nagaraj Shetti of HDFC Securities expects further weakness in the Nifty 50 in the short-term as the overall chart formation signals a short-term top reversal pattern at the recent highs. He expects the Nifty 50 to test crucial downside supports of 19,750 - 19,600 in the near-term, while any attempt of a bounce may find strong resistance around 20,050 - 20,100.

The Nifty 50 has dipped below its previous swing high on the daily chart, indicating a decline in bullish sentiment, said Rupak De of LKP Securities. A negative crossover is also evident on the daily RSI. He expects the Nifty 50 to fall towards 19,700 - 19,630 levels in the short-term. Selling on rallies may be a favourable strategy as long as the index remains below 20,000.

46,000 Now A Resistance For The Nifty Bank

Once cannot blame the Nifty Bank for the fall it had on Wednesday as majority of the fall came courtesy of HDFC Bank. The index fell nearly 600 points in mid-week trading, marking its worst single-day drop since August 2. The banking index is now down 800 points over the last two trading sessions and now over 1,000 points away from its record high of 46,369.

Breaching the key support level of 46,000 has now turned it into a resistance for the Nifty Bank, said Kunal Shah of LKP Securities. Immediate support on the downside now is 45,300, which is from where the index reversed on Wednesday (45,276), and a break below that can even take the index down to levels of 45,000.

Mehul Kothari of Anand Rathi expects some stability for the Nifty Bank around key support levels of 45,000 - 44,800. He now expects a fresh rally in the index only above levels of 46,400.

HDFC Bank: Key Levels To Watch Now

Now on to the big elephant in the room, HDFC Bank contributed to 50 percent of the Nifty 50 downside on Wednesday. The stock ended 4 percent lower after Nomura downgraded the stock to neutral and also cut its price target citing four negative surprises. Other brokerages may not have downgraded the stock but cut their respective price targets too.

Concerns on the street came from rising corporate NPAs of HDFC Ltd., which the bank highlighted in a recent analyst meet.

"We hold one of the leading banks, but our active position there is fairly limited. So overall, we are mindful of that as the company goes through the process of merger, some of these things will have to be ironed out over the next couple of quarters and then the synergy benefits will flow through. But we see that more as transient impact rather than any long standing quality issue with regards to the book that they operate," Trideep Bhattacharya of Edelweiss AMC told CNBC-TV18 when asked about HDFC Bank.

But what are the key levels to watch out for on HDFC Bank? Is there more downside in store? Read this piece to know more.

What Are F&O Cues Indicating?

Nifty 50's September futures shed 11 percent or 11.88 lakh shares in Open Interest on Wednesday. They are now trading at a premium of 70.65 points compared to 45.55 points earlier. The Nifty Bank's September futures also shed 10.9 percent or 1.63 lakh shares in Open Interest. Nifty 50's Put-Call Ratio is at now at 0.79 from 1.1 earlier.

Hindustan Copper is back in the F&O ban list from today's session, while IEX and REC are out of the ban. PNB, Delta Corp, Indiabulls Housing Finance, Balrampur Chini, BHEL, Zee Entertainment, Manappuram Finance and Chambal Fertilisers continue to remain in the ban period.

Nifty 50 on the Call side for September 21 expiry:

For today's weekly options expiry, the Nifty 50 call strikes between 19,900 and 20,100 have seen Open Interest addition with the 20,000 strike seeing the maximum Open Interest addition.

| Strike | OI Change | Premium |

| 20,000 | 1.6 Crore Added | 20.4 |

| 20,100 | 95.1 Lakh Added | 5.1 |

| 19,950 | 71.5 Lakh Added | 37.6 |

| 19,900 | 50.84 Lakh Added | 63 |

Nifty 50 on the Put side for September 21 expiry:

For today's expiry, the Nifty 50 put strikes between 19,700 and 19,900 have seen Open Interest addition. Although the 19,900 put has seen the maximum Open Interest addition, the quantum is not as much as the addition on the 19,900 call.

| Strike | OI Change | Premium |

| 19,900 | 36.93 Lakh Added | 43.65 |

| 19,700 | 33.69 Lakh Added | 5.05 |

| 19,800 | 21.41 Lakh Added | 15.55 |

Lets take a look at the stocks which saw fresh short positions on Wednesday, meaning a decrease in price but increase in Open Interest:

| Stock | Price Change | OI Change |

| HDFC Bank | -3.89% | 12.48% |

| Hero Moto | -1.38% | 8.86% |

| Berger Paints | -1.04% | 7.86% |

| SBI Cards | -1.27% | 7.21% |

| Reliance Industries | -2.14% | 6.55% |

Lets take a look at the stocks that saw unwinding of long positions on Wednesday, meaning a decrease in both price and Open Interest:

| Stock | Price Change | OI Change |

| IPCA Labs | -0.71% | -8.75% |

| Ramco Cements | -1.06% | -5.70% |

| PNB | -0.32% | -4.33% |

| Coromandel International | -1.31% | -3.69% |

| Indian Oil | -0.65% | -3.02% |

Despite a weak market, some stocks saw fresh long positions as well, meaning an increase in price and Open Interest:

| Stock | Price Change | OI Change |

| Glenmark | 1.38% | 11.24% |

| Hindustan Copper | 1.18% | 9.17% |

| Polycab | 3.10% | 6.48% |

| Axis Bank | 0.55% | 6.33% |

| PFC | 0.28% | 5.73% |

Here are the stocks to watch out for ahead of Thursday's trading session:

What Are Global Cues Indicating?

Markets across the Asia Pacific have opened lower, taking forward the weak closing on Wall Street.

The Nikkei 225 is down 0.4 percent as the Bank of Japan begins its two-day policy meet, while the Topix is down 0.2 percent.

South Korea's Kospi is down 0.5 percent and the Kosdaq is trading 0.4 percent lower.

On the other hand, Hang Seng's futures are pointing to a strong opening for the index.

Benchmark indices on Wall Street ended at the day's low after the US Federal Reserve indicated that they are not done hiking interest rates just yet.

The Dow Jones fell nearly 80 points, while the S&P 500 fell 1 percent. The Nasdaq fell 1.53 percent led by a drop in Microsoft, Nvidia and Alphabet.

Although the Fed left interest rates unchanged, it signalled one more hike and said it would begin cutting rates next year, signalling that they would remain higher for a long period.

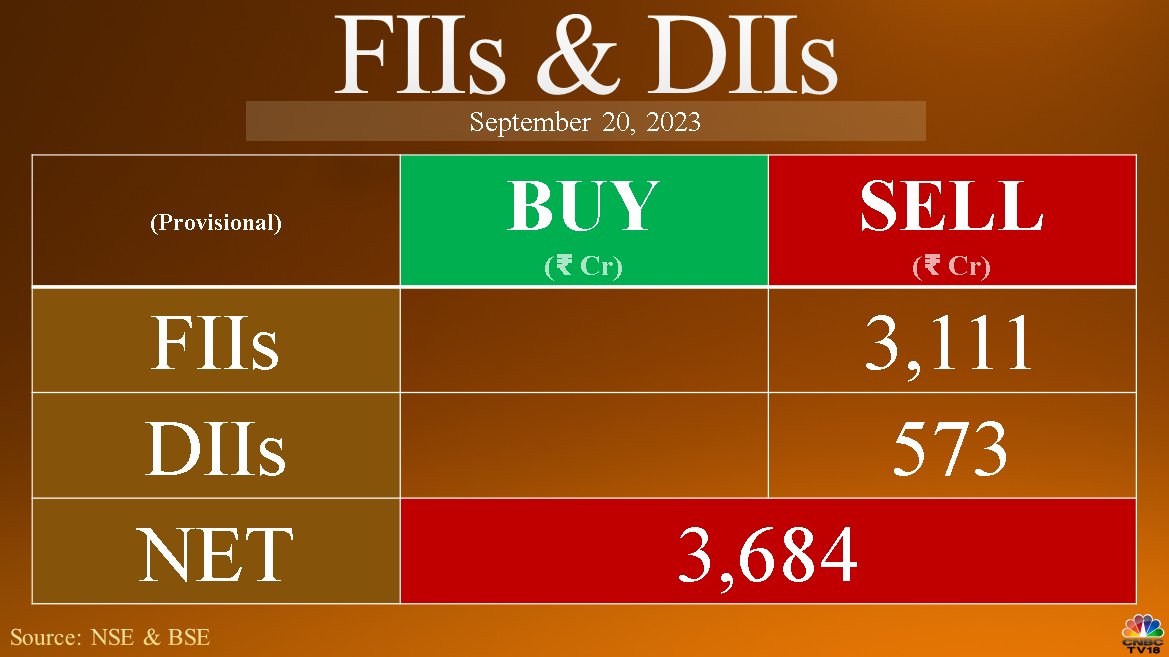

Both foreign and domestic investors were net sellers in the cash market on Wednesday.

Follow DS Trading Tech for the Share Market Update, Stocks News, upcoming IPO, Business Ideas, Financial Knowledge, Mutual Fund, Other Advertising, news and their reviews, also keep following us on Twitter, Facebook, and Instagram. For our latest videos, subscribe to our YouTube channel.

By DS Trading Tech

👉Connect With us-

👉E-mail : rjdilipsuthar@gmail.com

👉FACEBOOK : https://www.facebook.com/profile.php?...

👉INSTAGRAM: https://www.instagram.com/Dilipsuthafintech

👉YouTube: ![]() / @dstradingtech

/ @dstradingtech

Click Here