Trade setup for Monday: Top 15 things to know before the opening bell

Based on the OI percentage, 55 stocks were on the short-covering list. These included Balrampur Chini Mills, HDFC Bank, Tech Mahindra, Nestle India, and Coromandel International.

The market may see some consolidation before the next upmove towards 20,500.

The Indian equity market has been witnessing a consistent rally and most experts are expecting a consolidation. If the current momentum continues, then the immediate resistance for the Nifty50 can be 20,200-20,300, which also resembles the breakout point of the upward-sloping resistance trendline, followed by 20,500, while 20,000 is supposed to be the immediate crucial support.

The market jumped to a new record high on September 15, with the Nifty50 climbing above the 20,200 mark intraday for the first time. Positive global cues, falling volatility and uptrend in auto, banking and financial services, technology and pharma stocks aided the rally.

The BSE Sensex rose 320 points to 67,839, while the Nifty50 advanced 89 points to 20,192 and formed a bullish candlestick pattern with a minor upper shadow on the daily charts, making higher highs and higher lows formation for the second consecutive session.

"Strong Put writing at 20,100 has further bolstered positive sentiment in the market. The trend is expected to remain positive as long as the Nifty remains above the 20,000 mark," Rupak De, senior technical analyst at LKP Securities said.

In the short term, he feels there is potential for the Nifty to move towards the 20,480-20,500 range on the upside.

The broader markets closed moderately higher with the Nifty Midcap 100 and Smallcap 100 indices climbing 0.3 percent and 0.4 percent respectively, while the falling of India VIX, the fear index, by 3.66 percent to 10.9, will be a comfort for bulls.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks are the aggregates of three-month data and not just the current month.

Key support and resistance levels on Nifty

The pivot point calculator indicates that the Nifty may be taking support at 20,146, followed by 20,124 and 20,089. On the higher side, 20,217 can be an immediate resistance, followed by 20,239 and 20,274.

On September 15, the Bank Nifty performed better than the benchmark, rising 231 points to 46,232 and forming a bullish candlestick pattern on the daily timeframe with minor upper shadow. The immediate resistance for the index will be the record high of 46,370 on July 21.

"The Bank Nifty has now reached the zone of 46,370 – 46,400 where resistance in the form of weekly upper Bollinger band and the previous swing high is placed. Thus, after rallying for three weeks there is a high probability of a consolidation," Jatin Gedia, technical research analyst at Sharekhan by BNP Paribas said.

He feels the crucial support is placed in the range of 45,970– 45,670 and crucial resistance is placed at 46,300-46,400

As per the pivot point calculator, the banking index is expected to take support at 46,083, followed by 46,016 and 45,909. On the upside, the initial resistance is at 46,298, then 46,364 and 46,472.

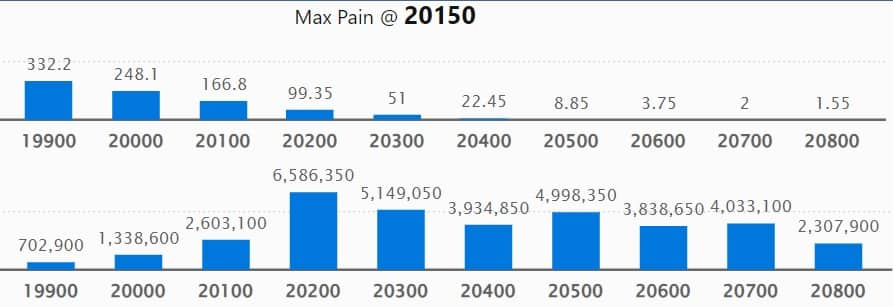

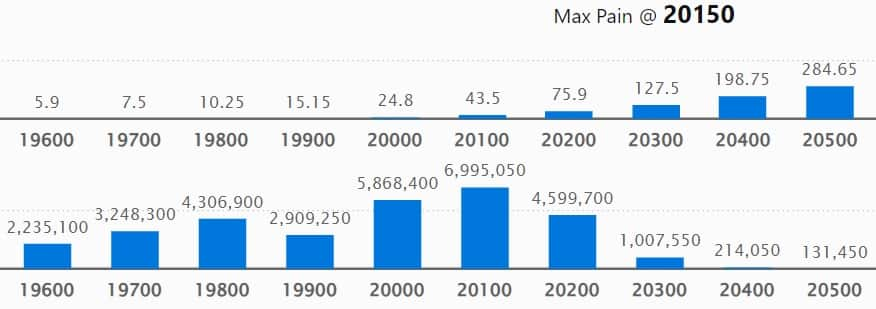

As per the options data, the maximum weekly Call open interest (OI) was at 20,200 strike, with 65.86 lakh contracts, which can act as a key resistance for the Nifty. It was followed by 20,300 strike, which had 51.49 lakh contracts, while 20,500 strike had 49.98 lakh contracts.

The meaningful Call writing was visible at 20,200 strike, which added 25.89 lakh contracts, followed by 20,500 and 20,300 strikes, which added 19.52 lakh and 14.91 lakh contracts.

The maximum Call unwinding was at 20,100 strike, which shed 10.45 lakh contracts, followed by 20,000 strike and 19,500 strike, which shed 5.93 lakh contracts, and 23,200 contracts.

On the Put side, the maximum open interest was at 20,100 strike, with 69.95 lakh contracts. This can be an important support for the Nifty in the coming sessions.

It was followed by 20,000 strike comprising 58.68 lakh contracts, and 20,200 strike with 45.99 lakh contracts.

The meaningful Put writing was at 20,200 strike, which added 34.26 lakh contracts, followed by 20,100 strike and 19,800 strike, which added 29.07 lakh and 16.33 lakh contracts.

Put unwinding was at 19,900 strike, which shed 91,700 contracts followed by 20,500 strike and 20,600 strike, which shed 90,500 and 2,250 contracts.

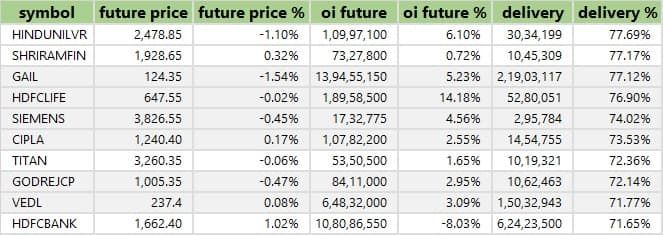

Stocks with high delivery percentage

A high delivery percentage suggests that investors are showing interest in the stock. Hindustan Unilever, Shriram Finance, GAIL India, HDFC Life Insurance Company, and Siemens have seen the highest delivery among the F&O stocks.

The long build-up was seen in 46 stocks on Friday, including Ipca Laboratories, Oracle Financial, Metropolis Healthcare, Bajaj Auto, and Dr Lal PathLabs. An increase in open interest (OI) and price indicates a build-up of long positions.

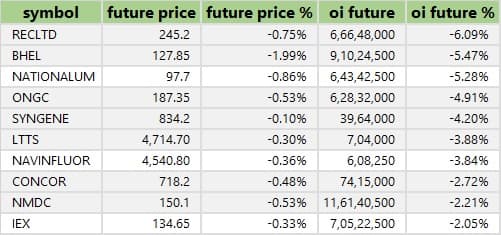

Based on the OI percentage, a total of 34 stocks including REC, BHEL, National Aluminium Company, ONGC, and Syngene International, saw long unwinding. A decline in OI and price indicates long unwinding.

52 stocks see a short build-up

The short build-up was seen in 52 stocks. These included Apollo Tyres, IndiaMART InterMESH, HDFC Life Insurance Company, Britannia Industries, and Hindustan Unilever. An increase in OI along with a fall in price points to a build-up of short positions.

Based on the OI percentage, 55 stocks were on the short-covering list. These included Balrampur Chini Mills, HDFC Bank, Tech Mahindra, Nestle India, and Coromandel International. A decrease in OI along with a price increase is an indication of short-covering.

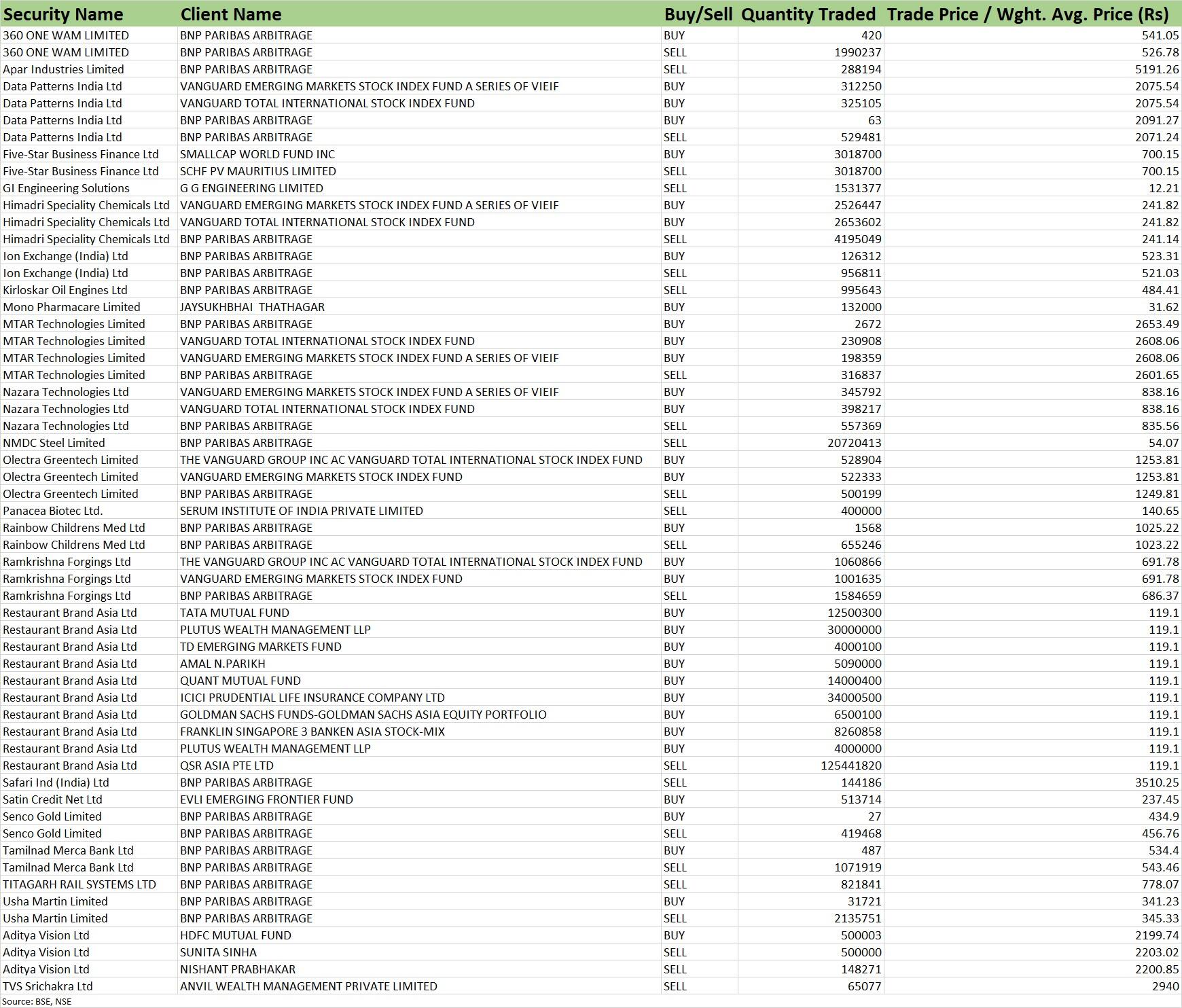

Restaurant Brands Asia: Tata Mutual Fund, Plutus Wealth Management LLP, TD Emerging Markets Fund, Amal N Parikh, Quant Mutual Fund, ICICI Prudential Life Insurance Company, Goldman Sachs Funds-Goldman Sachs Asia Equity Portfolio, and Franklin Singapore 3 Banken Asia Stock-Mix have cumulatively bought 23.92 percent stake or 11.83 crore equity shares worth Rs 1,349 crore, via open market transactions, in the quick-service restaurant chain. However, promoter entity QSR Asia Pte Ltd was the seller in the deal, offloading 12.54 crore shares, equivalent to 25.36 percent of paid-up equity, at an average price of Rs 119.1 per share. As of June 2023, QSR Asia has 40.8 percent shares in the company.

(For more bulk deals, click here)

Investors meeting on September 18

Manappuram Finance: Officials will meet representatives of NVS Brokerage.

Kirloskar Industries: Senior officials of the company will interact with LIC Mutual Fund.

Stocks in the news

Tata Steel: The Tata group company and the UK government announced a joint agreement to invest 1.25 billion pounds in electric arc furnace steelmaking at the Port Talbot site. This included a grant from the UK government of up to 500 million pounds. The Port Talbot project will reduce direct emissions by 50 million tonnes over 10 years. Further, the project would also involve Tata Steel’s balance sheet being restructured with potential elimination of the current cash losses in the UK operations and non-cash impairment of legacy investments.

Jupiter Life Line Hospitals: The Mumbai-based healthcare services provider will list its equity shares on the BSE and NSE on September 18. The issue price has been fixed at Rs 735 per share.

Hindustan Aeronautics: Defence Acquisition Council has accorded approval for Acceptance of Necessity (AON) for the procurement of 12 Su-30MKI Aircraft from Hindustan Aeronautics, with associated equipment and avionics upgradation of Dornier Aircraft.

Bharat Electronics: The state-owned defence company has received an order of Rs 2,118.57 crore from Cochin Shipyard for the supply of various equipment consisting of sensors, weapon equipment, fire control systems and communication equipment for six numbers of Next Generation Missile Vessels (NGMV), class of anti-surface warfare corvettes for Indian Navy.

Indian Oil Corporation: The company has received board approval for an additional investment of Rs 903.52 crore in Hindustan Urvarak and Rasayan (HURL). HURL is a joint venture of Indian Oil incorporated for setting up of fertiliser plants at Gorakhpur, Sindri and Barauni.

Texmaco Rail & Engineering: The rail solution provider has received approval from the board of directors for raising funds up to Rs 1,000 crore via the issuance of equity shares through qualified institutions placement (QIP). Further, it also got approval for raising funds up to Rs 50 crore via preferential issue to promoters.

Zomato: Zomato Slovakia s.r.o, the step-down subsidiary of the food delivery giant in Slovak Republic initiated the process of liquidation on September 14. Further, Zomato Slovakia does not have any active business operations. Zomato Slovakia is not a material subsidiary of the company, and the dissolution of Zomato Slovakia will not affect the turnover/revenue of the company.

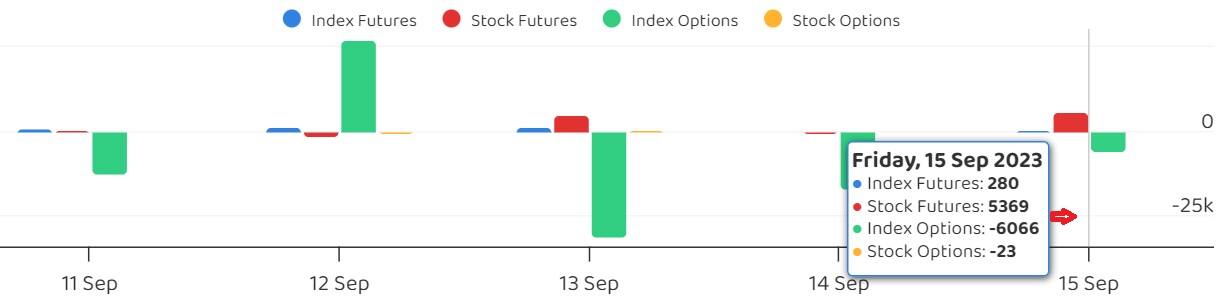

Fund Flow (Rs Crore)

Foreign institutional investors (FII) bought shares worth Rs 164.42 crore, while domestic institutional investors (DII) purchased Rs 1,938.57 crore worth of stocks on September 15, provisional data from the National Stock Exchange (NSE) showed.

Stocks under F&O ban on NSE

The NSE has added Chambal Fertilizers & Chemicals to its F&O ban list for September 18, while retaining Balrampur Chini Mills, BHEL, Hindustan Copper, Indiabulls Housing Finance, Indian Energy Exchange, India Cements, Manappuram Finance, REC and Zee Entertainment Enterprises. Three stocks - Delta Corp, National Aluminium Company, and SAIL removed from the said list.

Securities banned under the F&O segment include companies where derivative contracts cross 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Follow DS Trading Tech for the Share Market Update, Stocks News, upcoming IPO news and their reviews, also keep following us on Twitter, Facebook, and Instagram. For our latest videos, subscribe to our YouTube channel.

By DS Trading Tech

👉Connect With us-

👉E-mail : rjdilipsuthar@gmail.com

👉FACEBOOK : https://www.facebook.com/profile.php?...

👉INSTAGRAM: https://www.instagram.com/Dilipsuthafintech

👉YouTube: ![]() / @dstradingtech

/ @dstradingtech

Click Here