10 best bets for next 3-4 weeks as experts predict some correction from record highs

Since the broader markets are overstretched, failing to clear the high might trigger some profit-booking. Traders should remain extremely stock-specific and follow strict stop-losses, advised experts

Top 10 trading ideas for next 3-4 weeks

The market went on a rally since the start of September and recorded nearly 5 percent gains so far. It hit a historic high and zoomed 1.9 percent last week. This is, therefore, the time for the market to see some retraction and some bearish divergence too, with price making higher highs, and momentum indicator RSI (relative strength index) making lower highs on the daily charts. A similar situation is seen on the weekly charts as well.

The Nifty50 may see some consolidation and correction, taking support at the 20,000-19,900 area, whereas a rebound after the possible correction may take the index towards 20,500 mark, experts said.

The index jumped 372 points last week to 20,192 points and formed a bullish candlestick pattern on the daily charts with above-average volumes for the third straight week.

"Indicators have entered the overbought zone, and the daily chart displays small-body candles, suggesting some signs of fatigue among the bulls," Sameet Chavan, research head for technical and derivatives at Angel One, said.

He feels that the next leg of up-move may not be as swift as recent times, potentially involving in-between pauses or price corrections. The overall sentiment remains positive, and the advisable approach is to view dips as buying opportunities, he said.

In this scenario, he feels the previous resistance of around 20,000 is likely to act as an immediate support, while Tuesday's panic low of 19,900 remains a critical pivot point. On the other hand, in the uncharted territory, the next resistance zone lies in the 20,400-20,500 range.

In the coming sessions, Jigar Patel, senior manager for equity research at Anand Rathi, also feels that 20,400 might act as an immediate hurdle for the Nifty50 since that is the placement of a rising trendline. On the downside, 20,000–19,000 now might be a decisive support for the short term.

Since the broader markets are overstretched, failing to clear the high might trigger some profit-booking. Thus, he advised traders to remain extremely stock-specific and follow strict stop-losses.

Let's take a look at the top 10 trading ideas from experts for the next three-four weeks. Returns are based on the September 8 closing prices.

Expert: Viraj Vyas, CMT, Technical & Derivatives Analyst - Institutional Equity at Ashika Stock Broking

Mahindra & Mahindra: Buy | LTP: Rs 1,601 | Stop-Loss: Rs 1,520 | Target: Rs 1,800 | Return: 12.4 percent

This stock stands out as one of the top performers in the auto sector, which has experienced a significant and robust upward trend from April 2023 to July 2023. During this period, the stock surged from Rs 1,100 levels to Rs 1,600 levels.

Subsequently, the stock transitioned into a consolidation phase, forming what appears to be an Ascending Triangle pattern. It's worth noting that this pattern is typically considered bullish in nature. A potential breakout above the Rs 1,605-1,610 levels is anticipated to initiate the next leg of its upward move.

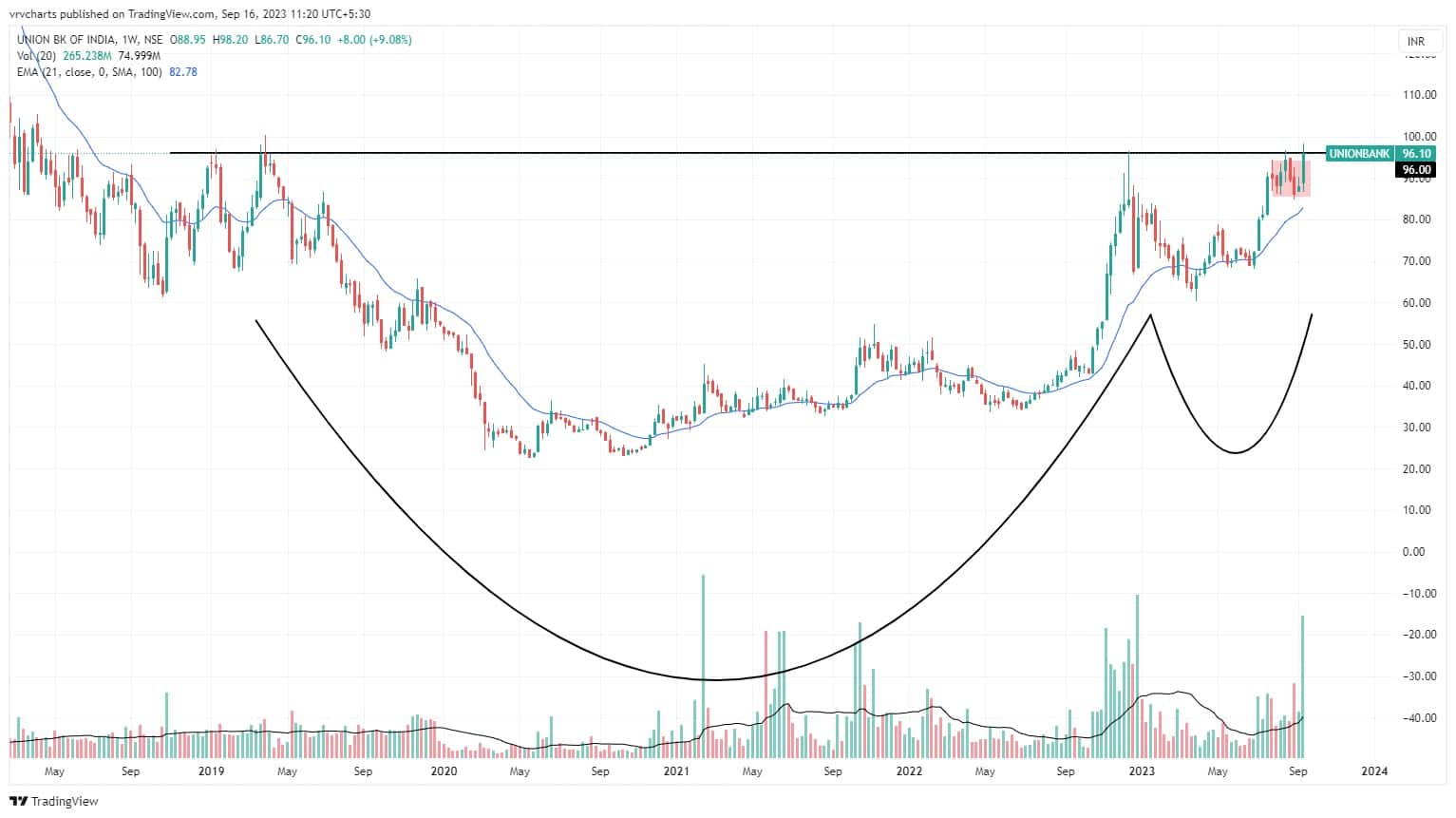

Union Bank of India: Buy | LTP: Rs 96 | Stop-Loss: Rs 86 | Target: Rs 120 | Return: 25 percent

Among the banking sector, particularly in PSU banking stocks, there has been a notable surge in momentum in recent weeks. Many of these stocks, including Union Bank, had been consolidating for an extended period. In the case of Union Bank, the stock had been in consolidation mode from 2019 until around 2023. This consolidation phase has taken the form of a Cup and Handle pattern, which is typically indicative of accumulation and a potential bottoming out process.

Notably, in the previous week, there was a significant increase in trading volumes, suggesting that the stock is poised to break above its resistance area and potentially initiate a strong upward move, targeting Rs 120-125 zone.

Coforge: Buy | LTP: Rs 5,619 | Stop-Loss: Rs 5,350 | Target: Rs 6,300 | Return: 12 percent

The stock has exhibited robust performance over the past few weeks, capitalizing on the strong performance of Nifty IT stocks, even as the broader market approaches the end of a two-year corrective phase. During its ascent, the stock has been shaping a rounding pattern, and it recently achieved a breakout above the golden ratio of a prior downward move (Rs 4,500-3,250).

Maintaining levels above Rs 5,350 indicates a favourable outlook for the ongoing upward trend, and the stock is poised to target Rs 6,200-6,300 range. While a minor obstacle may be encountered around Rs 6,000 levels, the overall trajectory remains promising.

Expert: Vinay Rajani, CMT, senior technical & derivative analyst at HDFC Securities

Canara Bank: Buy | LTP: Rs 365 | Stop-Loss: Rs 350 | Target: Rs 399 | Return: 9 percent

The stock price has broken out from downward sloping trendline on the monthly chart. Price breakout is accompanied with a jump in volumes. Stock price is trading above its 20, 50 and 200 DMA, indicating bullish trend on all time frame.

Indicators and oscillators like MACD (moving average convergence divergence) and RSI (relative strength index) have turned bullish on the monthly charts. Nifty PSU Bank index has broken out from the consolidation.

UPL: Buy | LTP: Rs 634.65 | Stop-Loss: Rs 602 | Targets: Rs 680-720 | Return: 13 percent

The stock price has broken out from bullish Inverted Head and Shoulder pattern on the daily chart. Stock has surpassed the crucial resistance of 5-day EMA (exponential moving average). Price breakout is accompanied with jump in volumes. Indicators and oscillators have turned bullish on the daily charts. Chemical sector has started outperforming for last two weeks.

Triveni Turbine: Buy | LTP: Rs 433.35 | Stop-Loss: Rs 410 | Targets: Rs 480-520 | Return: 20 percent

The stock price has broken out from the multi-week consolidation. Price breakout is accompanied by jump in volumes. Stock is trading above all important moving averages, which indicates bullish trend on all time frames. Stock price has been forming higher tops and higher bottoms on weekly charts.

Expert: Shrikant Chouhan, head of research (retail) at Kotak Securities

Zydus Lifesciences: Buy | LTP: Rs 645 | Stop-Loss: Rs 620 | Targets: Rs 675-700 | Return: 8.5 percent

The stock market is currently displaying a bullish trend and is trading above all significant averages. Furthermore, it has formed a Flag formation that suggests the bullish trend would persist.

Therefore, it is anticipated that the stock could increase to Rs 675, which was the previous all-time high. In an optimal scenario, it may even reach Rs 700 if it surpasses the previous high. If you wish to take a long position in the stock, it is advisable to set a stop loss at Rs 620.

DCW: Buy | LTP: Rs 58.5 | Stop-Loss: Rs 53 | Targets: Rs 66-75 | Return: 28 percent

The stock is breaking out of a multi-year resistance level and has formed a symmetrical triangle on the long-term charts. Recently, the stock closed below the upper boundary of the triangle formation. However, we believe that it is now ready to move towards the target based on the triangle pattern.

According to the triangle formation, the stock may reach upward levels of Rs 66, Rs 75, and Rs 90 in the medium to long term. We suggest buying at the present level and placing a stop loss at Rs 53 to minimize potential losses.

Tata Steel: Buy | LTP: Rs 132 | Stop-Loss: Rs 126 | Targets: Rs 140-145 | Return: 10 percent

The sector is a bright spot in the current economic climate, playing a significant role in the overall growth. Tata Steel, in particular, stands out with exceptional performance in the same category.

Notably, it formed a continuation high before breaking out of a trading range of Rs 133 last Thursday. Based on technical analysis, the next levels to watch for are Rs 140 and Rs 145, respectively. It is advisable to consider buying at current levels, with a stop loss set at Rs 126.

Expert: Mitesh Karwa, research analyst at Bonanza Portfolio

ICICI Prudential Life Insurance: Buy | LTP: Rs 595 | Stop-Loss: 560 | Target: Rs 654 | Return: 10 percent

The stock has seen breaking out of a bullish pattern on the weekly timeframe after almost two years with a big bullish candlestick and above average volumes, adding to it the stock is trading and sustaining above all its important EMAs which can be used as a confluence towards the bullish view.

On the indicator front, the Ichimoku Cloud is also suggesting a bullish move as the price is trading above the conversion line, base line and cloud. Momentum oscillator RSI (14) is at around 64 on the daily time frame indicating strength by sustaining above 50.

Observation of the above factors indicates that a bullish move in stock is possible for target upto Rs 654. One can initiate a buy trade in between the range of Rs 590-595 stop-loss of Rs 560 on daily closing basis.

Bandhan Bank: Buy | LTP: Rs 249 | Stop-Loss: Rs 235 | Target: Rs 270 | Return: 8 percent

Bandhan Bank has seen breaking out of a downwards sloping resistance trendline on the weekly timeframe with above average volumes and a bullish candlestick after bouncing back from important support zones. Adding to it the stock is trading above important EMAs of 20/50/100/200 on the daily timeframe which indicates strength.

On the indicator front, momentum oscillator RSI (14) is at around 65 on the daily time frame indicating strength by sustaining above 50. The Ichimoku Cloud is also suggesting a bullish move.

Observation of the above factors indicates that a bullish move in Bandhan Bank is possible for target upto Rs 270. One can initiate a buy trade in the range of Rs 247-249 with a stop-loss of Rs 235 on daily closing basis.

Disclaimer: The views and investment tips expressed by investment experts on DS Trading Tech are their own and not those of the website or its management. DS Trading Tech advises users to check with certified experts before taking any investment decisions.

Follow DS Trading Tech for the Share Market Update, Stocks News, upcoming IPO news and their reviews, also keep following us on Twitter, Facebook, and Instagram. For our latest videos, subscribe to our YouTube channel.

By DS Trading Tech

👉Connect With us-

👉E-mail : rjdilipsuthar@gmail.com

👉FACEBOOK : https://www.facebook.com/profile.php?...

👉INSTAGRAM: https://www.instagram.com/Dilipsuthafintech

👉YouTube: ![]() / @dstradingtech

/ @dstradingtech

Click Here